Cleveland Fire Authority Agrees to Liquidate Its Own Company and Write Off £71,000 Debt, After £1.2m Tax Collapse...

- teessidetoday

- Aug 9

- 5 min read

Updated: Aug 15

The case had been due to go back before the High Court later this month, however, its now claimed bosses have voluntarily agreed to liquidate the business after it amassed huge debts.

9th August 2025

Cleveland Fire Authority has voted to liquidate a company they fully own after it racked up more than £1.2 million pounds worth of unpaid tax bills and debts.

The decision to liquidate Cleveland Fire Brigade Risk Management Services CIC was reportedly made at an extraordinary meeting on 1 August 2025 which also saw officials approving the write-off of approximately £71,000 owed to Cleveland Fire Authority by the failing company, with reports detailing the losses will be mitigated using investment income which, according to officials, "has exceeded the budget forecast for the current year".

Cleveland Fire Brigade Risk Management Services CIC, was set up in 2011 to generate profits for community safety projects & was supposed to be a self-sustaining commercial arm of Cleveland Fire Authority. Under its constitution, 65% of any profits were supposed to be distributed to good causes, with the remaining 35% reinvested into the business.

For years, the company was said to have traded successfully and made a number of charitable contributions. However by 2024/25, its business model quickly collapsed, seeing its debt liabilities spiral out of control & directors failing to get a grasp of the scale of the predicament they were in...

How It Fell Apart

The company’s financial decline apparently became terminal when HMRC petitioned the High Court earlier this year to wind up the failing corporation over a huge backlog of unpaid income tax, national insurance, and VAT the business had accrued. Although HMRC were said to have 'generously deferred' payments at times, its claimed the debt mountain only grew.

In early 2025, external insolvency specialists FRP Advisory were said to have been brought in to see if the CIC or its contracts could be sold. FRP Advisory reportedly found no viable buyer for the company or its operations. On 31 July 2025, Cleveland Fire Brigade Risk Management Services CIC ceased trading altogether & its website taken down from publication...

The liquidation will now see around 38 jobs lost, with only about eight staff possibly transferring to other employment under TUPE rules. The winding-up process is said to have been accelerated so workers can make claims to the Government’s Redundancy Payment Service for redundancy pay, notice pay, and unpaid holidays...

The £71,000 Loss — and Where It Came From

The majority of the unrecoverable £71,000 reportedly relates to a 2017 £150,000 loan from Cleveland Fire Authority to the CIC to purchase a 50% stake in Command Solutions Ltd, a private corporation registered in Church Street Hartlepool & directed by former Chief Fire Officer Ian Hayton, the director of the now collapsed Cleveland Fire Brigade Risk Management Services CIC, supposedly developing a “command support system” for fire brigades.

The other 50% of the company was supposedly owned by engineering software provider IAMTech. But, in a report, its claimed progress was said to have been “much slower than anticipated”, delaying sales and repayments. By March 2024, its said that £48,000 plus interest was still owed; a further £18,000 was then due in 2025/26.

At the time of liquidation, its claimed £66,060.21 remained unpaid.

The second chunk of the debt — £39,959.72 — is said to relate to unpaid charges under a Service Level Agreement (SLA) for services provided by Cleveland Fire Authority to Cleveland Fire Brigade Risk Management Services CIC. Payments for 2024/25 were deferred to help cash flow, but the CIC later terminated the SLA altogether. Cleveland Fire Authority reportedly then cut off all remaining services in June 2025.

Notably, this loss comes despite Cleveland Fire Brigade Risk Management Services CIC, having fully repaid another much larger £423,621 operational vehicle loan in June 2024.

A Short-Lived “Replacement” Company

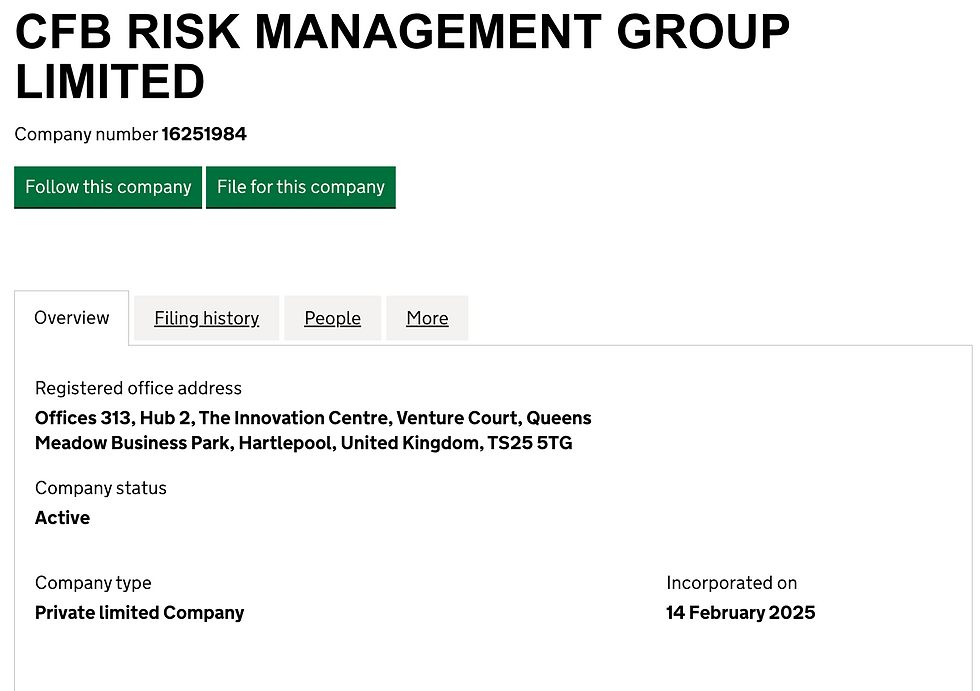

In February 2025, as Cleveland Fire Brigade Risk Management Services CIC's financial troubles deepened, a new company was then set up — CFB Risk Management Group Limited. Owned entirely by the former directors of the now collapsed CIC.

When questioned on this at an earlier court hearing following the revelation of the new business in a previous Teesside & Durham Post Exclusive report, Directors claimed the new business was intended to secure contracts from clients unable to award work to a community interest company. However, with Cleveland Fire Brigade Risk Management Services CIC now entering liquidation, the new business CFB Risk Management Group Limited is also set to be struck off the Companies House register after its claimed the court was 'unconvinced' as to the directors motives for setting up the new corporation.

Considerable Reputational Damage has arisen from the incident.

Cleveland Fire Brigade Risk Management Services CIC was said to have been 100% owned by Cleveland Fire Authority, whose sole liability in law was limited to just £1.

However, officials acknowledged in the meeting papers as seen by The Teesside & Durham Post that considerable reputational damage to Cleveland Fire Authority from the collapse of the CIC had occurred because of the firms collapse, with the fallout set to be long lasting.

The CIC’s directors included the former Chief Fire Officer and former Assistant Chief Fire Officer – Strategic Planning & Resources, as well as a former Chief Solicitor to Hartlepool Borough Council Peter Devlin, who resigned from the board of the CIC just weeks before it was petitioned for insolvency by HMRC. Its claimed other board members reportedly worked 'unpaid'.

While the Authority itself is not legally liable for the CIC’s £1.2m debt to HMRC and other creditors, the collapse has now ultimately left taxpayers to shoulder the firms losses which have been written off...

What Happens Next

Liquidators will now begin winding up Cleveland Fire Brigade Risk Management Services CIC's affairs.

Its claimed HMRC, as the priority creditor, will receive whatever can be recovered from the failed corporation in due course, with reports already emerging that there's said to be little prospect of there being any payment for other creditors.

This collapse marks the end of a 14-year venture that began with the promise of generating commercial income for local good causes — and ended with over a million pounds in unpaid debts, job losses, and yet another dent in public trust over enterprises ran by former heads of local authorities & a former Hartlepool Borough Council Chief Solicitor, who jumped ship seemingly at the right time..

Cleveland Fire Brigade’s press office confirmed the extraordinary meeting had taken place on August 1st and its agenda but offered no further comment...

Read our Previous Reports

July 11th 2025

FOLLOW-UP: Fire Brigade-Backed Hartlepool Company Owes £1.2M in Debts as Insolvency Looms – Ex-Council Officials Said to be at the Heart of The Scandal

July 1st 2025